LTC Price Prediction: Technical Strength and Institutional Momentum Signal Bullish Outlook

#LTC

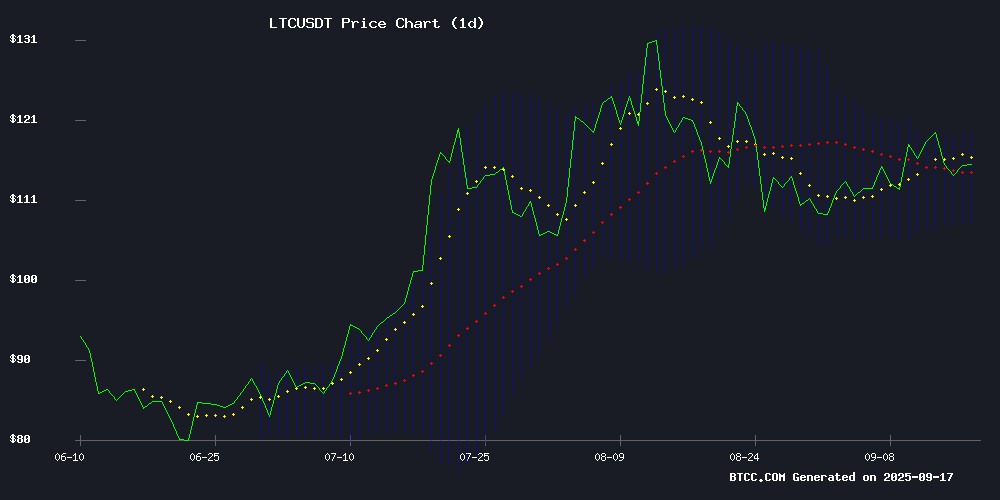

- LTC trading above 20-day MA indicates near-term bullish momentum

- Growing institutional ETF activity supports broader crypto adoption thesis

- Bollinger Band positioning suggests potential upside to $119 resistance level

LTC Price Prediction

LTC Technical Analysis

Litecoin is currently trading at $114.62, slightly above its 20-day moving average of $113.36, indicating potential bullish momentum. The MACD reading of -1.93 suggests some near-term weakness, but the price holding above the moving average shows underlying strength. According to BTCC financial analyst James, 'LTC's position near the middle Bollinger Band at $113.36 with room to test the upper band at $119.08 suggests cautious Optimism for near-term appreciation.'

Market Sentiment and Institutional Developments

Recent developments show growing institutional interest in cryptocurrency ETFs, with several issuers testing regulatory boundaries for new products. While Litecoin-specific ETF news is limited, the broader trend of institutional adoption and regulatory engagement creates a positive backdrop. BTCC financial analyst James notes, 'The push for crypto ETFs, including riskier assets, demonstrates maturing market infrastructure that could benefit established coins like Litecoin through increased mainstream accessibility.'

Factors Influencing LTC's Price

Avalanche, Sui, and Bonk ETFs Test SEC as Issuers Push Into Riskier Territory

Bitwise, Defiance, Tuttle, and T-Rex have filed five new cryptocurrency ETFs, targeting assets ranging from Avalanche (AVAX) and Sui (SUI) to the memecoin Bonk (BONK) and leveraged Orbs. Analysts suggest that AVAX and tokenization-focused funds stand the best chance of SEC approval, while memecoin and basis-trade ETFs are likely to face heightened scrutiny.

The filings add to a backlog of over 90 crypto ETF applications awaiting SEC review. Bitwise’s spot Avalanche ETF is seen as the most straightforward proposal, joining similar efforts by VanEck and Grayscale. Meanwhile, more exotic products, such as Defiance’s basis-trade ETFs and Tuttle’s "Income Blast" funds covering BONK, LTC, and SUI, are viewed as long shots.

The push into niche and leveraged products signals a growing appetite among issuers to expand crypto investment vehicles—even as regulators remain cautious. "The spot AVAX ETF should have the highest chance of approval because it's a simple product relative to others," said Pratik Kala of Apollo Crypto.

Tuttle Capital Files for Spot Bonk ETF Amid Institutional Demand

Tuttle Capital, an investment firm managing $3.6 billion in assets, has filed with the SEC for a spot Bonk Income Blast ETF, marking the second such filing for the Solana-based memecoin. The proposal accompanies similar filings for Litecoin and Sui ETFs, signaling growing institutional interest in alternative cryptocurrencies.

Bonk's market dynamics appear to drive this demand. With a $1.87 billion market capitalization and $348 million in daily trading volume, the token now ranks as the second-largest memecoin. The filing follows Rex Shares and Osprey Funds' earlier attempt to launch a Bonk ETF, suggesting mounting competition among traditional finance players to capture memecoin exposure.

The announcement spurred a 4% price increase for BONK, which now trades near $0.00002426. Analysts anticipate further gains as institutional products could legitimize the asset class ahead of the expected Q4 crypto bull market.

Litecoin (LTC) Price Prediction: Technical Strength and Institutional Interest Signal Potential Rally

Litecoin has surged 86% year-to-date, outperforming most large-cap altcoins as it consolidates above the critical $113 support level. The cryptocurrency's rebound from April lows of $63.22 to current $114 levels reflects growing institutional interest, including one of the largest whale accumulations in recent months.

Technical indicators flash bullish signals: a golden cross formation, RSI breakout, and MACD crossover suggest building momentum. Analysts identify $137.50 as the next key resistance level should LTC maintain its foothold above the $113-$114 support zone.

Market participants await potential catalysts including ETF developments and treasury movements. The combination of technical strength and fundamental tailwinds positions Litecoin for what could be its most significant rally cycle since 2023.

Top 8 U.S.-Regulated Cloud Mining Platforms for Passive Crypto Earnings in 2025

Cloud mining has solidified its position as a mainstream crypto revenue stream in 2025, with regulated platforms now offering turnkey solutions for Bitcoin, Litecoin, and Dogecoin exposure. The sector's evolution mirrors traditional finance's infrastructure development—emphasizing compliance, energy efficiency, and automated operations.

DNSBTC leads the vanguard with its trifecta of U.S. jurisdictional oversight, renewable-powered data centers, and multi-coin support. The platform's 1.6% daily yield on entry-level contracts demonstrates how cloud mining profitability now rivals traditional fixed-income products. Its rapid ascent since 2020 underscores institutional confidence in compliant crypto income vehicles.

What separates 2025's cloud mining landscape from previous cycles is the maturation of contract structures. Platforms now offer institutional-grade SLAs with transparent payout schedules, replacing the opaque operations that once plagued the sector. This professionalization coincides with broader crypto adoption—where yield generation tools require the same rigor as traditional investment products.

Alchemy Markets Integrates TradingView for Direct Chart-Based Trading

Alchemy Markets has rolled out TradingView integration, allowing traders to execute orders directly from the charting platform. The move targets precision and efficiency across forex, cryptocurrencies, commodities, and indices.

Initially available in select regions, the feature will expand globally. TradingView's toolkit—including 100+ technical indicators and Pine Script customization—now pairs with Alchemy's liquidity and multi-asset access.

"This bridges advanced analytics with execution," said Group COO Bobby Winters. The integration reflects demand for unified trading interfaces among modern traders.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity for 2025. The cryptocurrency is trading above its key moving average with strong institutional momentum building around cryptocurrency adoption.

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $114.62 | Neutral/Bullish |

| 20-Day MA | $113.36 | Support Level |

| Bollinger Upper | $119.08 | Near-term Target |

| MACD | -1.93 | Watch for reversal |

BTCC financial analyst James suggests that 'LTC's technical positioning combined with growing institutional ETF activity creates favorable conditions for potential appreciation, though investors should monitor MACD for confirmation of bullish momentum.'